By Matt Lambert

All of the ingredients needed for making a sound, long-term, and lucrative real estate investment are in the bowl. If you are at a point in your life where there is more disposable income and words like retirement, 401k, defined benefits and IRA’s are becoming more common, then adding real estate to your portfolio should be strongly considered.

Many Millennials claim that they prefer renting to keep things fluid and flexible. This could also be partially PFSD. Post Financial Stress Disorder. Most of our generation was fresh out of college or just starting true adult life when the crash happened. If the crash did not affect your personal finances there is a good chance it did affect your parents, siblings or extended family. If this is the case, I encourage you to think again and address these fears with logic that can be found in data.

The crash was fueled by over-leveraging properties, non-existent underwriting, weak rental markets, higher interest rates, less focus on cash flow vs speculative appreciation and many other other things. The fact is the market ingredients needed to make a sound investment are here now. Couple that with your growing financial responsibility and it’s time to become a landlord.

Have no fear, it sounds daunting and like a big pain in the a**… But, trust me, once you get rolling you realize it is easy and an amazing way to make your money work for you in a passive way. Like the great Gary V says… passive income only exists in real estate. Anywhere else it is a fairy tale.

The fact is, a few extra hours of work a year will change your life and financial future forever.

The key factor is smart leverage. There are many different ways to approach this depending on your financial position. I am going to approach this from two different scenarios, first being a couple who owns a home and wants to buy a larger home. Second, being a single person who is deciding between owning and renting. To make this less complex, I am going to leave out any sales fees, taxes or penalties due upon liquidation of the investments. There are many different ways you could approach this from a tax standpoint, which is a conversation with a seasoned tax advisor.

First Scenario: Deciding Between Selling & Renting/Holding Existing Home:

Tim and Tina bought a home three years ago. They originally put down 10% ($20,000) on a $200,000 property.

Since then the property has appreciated enough to remove their PMI “Private mortgage insurance”. PMI is applied to mortgages with more than 80% loan-to-value at the close of escrow. Tim and Tina locked in a good rate of 4.2% and currently have a monthly mortgage payment of $938.91 + $66.67 for homeowners insurance + $125.00 for property taxes. The grand total monthly payment is $1,130.58, a principal balance of $173,000 and a value of $240,000.

Tim and Tina have decided they need a larger home and want to move. They have been saving money and are in a financial position to put up to $50,000 down. They could sell and pay taxes on gains and put money into other investments or keep the house and rent it out. Let’s take a look at the numbers.

Selling Home & Investing Money In Market.

Tim and Tina decide to sell their home and buy a new one.

They list their home with EVOAZ.COM for 5% and get it under contract for $240,000.

Fees incorporated

$240,000 x 5% = $12,000

Title Fees $2,000

Inspection repairs $1,000

Total fees $15,000

They Net $225,000

Total Proceeds $52,000

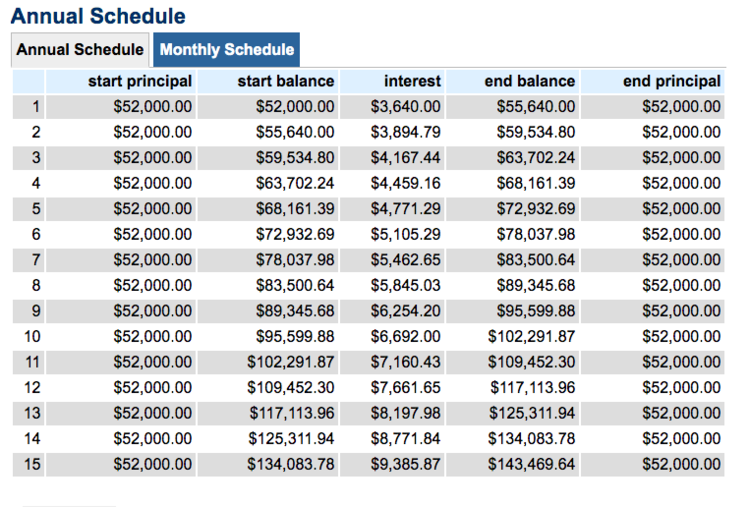

IF Tim and Tina Invested the entire $52k and they get 7% annually, it’s aggressive, but let’s roll with it for the sake of the example.

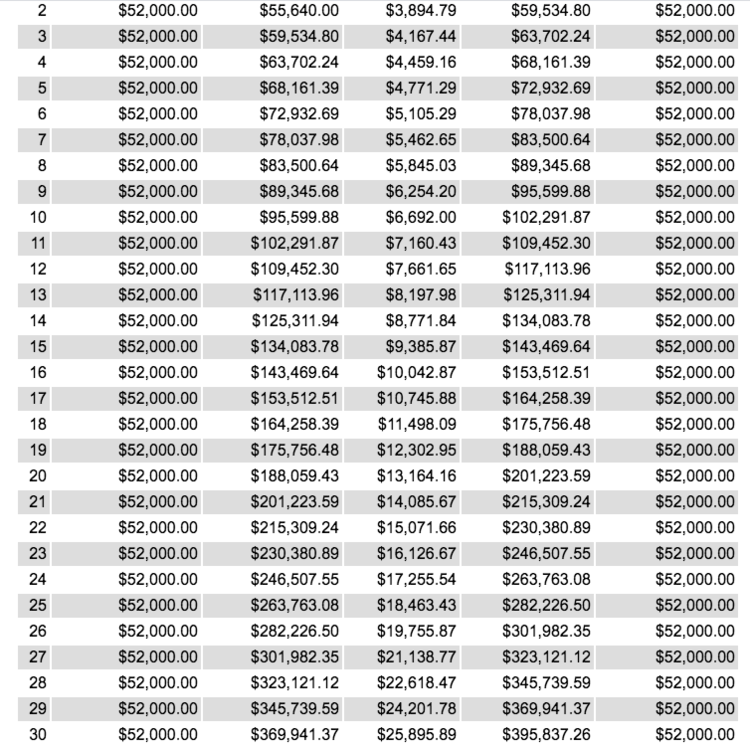

30 year Breakdown below.

30 year value $395, 837

Rental Investment Route

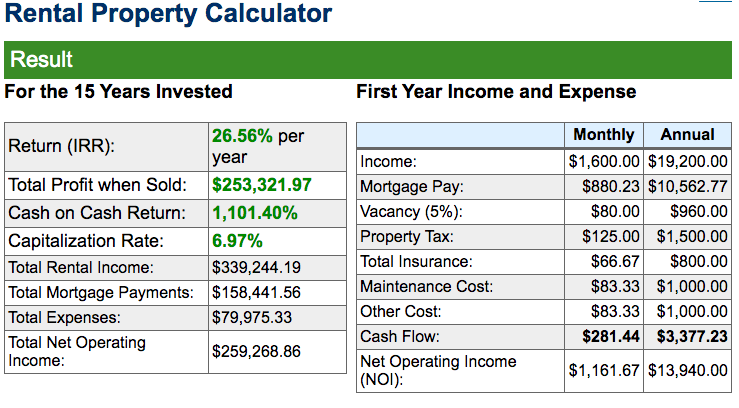

Right now Tim & Tina could easily rent their currently home out for $1600 a month. Let’s apply a 3% increase annually to all incomes and debts across the board.

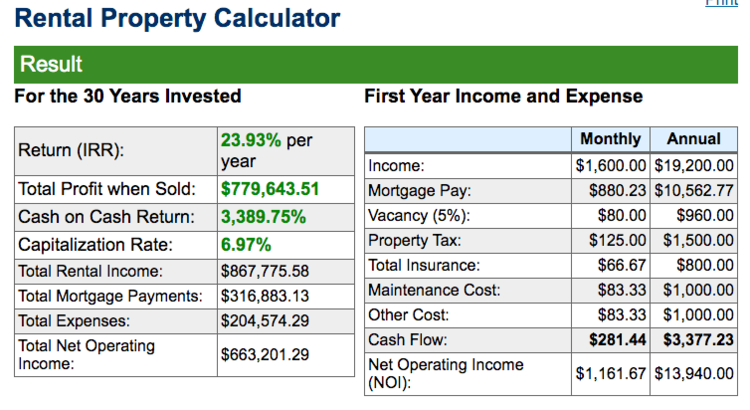

30 year Breakdown below

15 years value $253,737

30 Years the asset/investment Value $779,643

Possible Difference in 30 years

$383,806 more going rental route!!

Second Scenario: Deciding Between Renting & Owning.

John is kicking a** at life. He is happy and has a great job that allows him to work remotely. This allows John the freedom to travel when he likes and not be tied down to one area. This is a reason he wants to rent as there is no commitment and he can just move around and not be tied down.

John has been saving money and just hit a bonus. He has $25,000 to invest in his retirement and future.

Market Investment Route

He gives $25,000 for a 7% annual gain for 30 years.

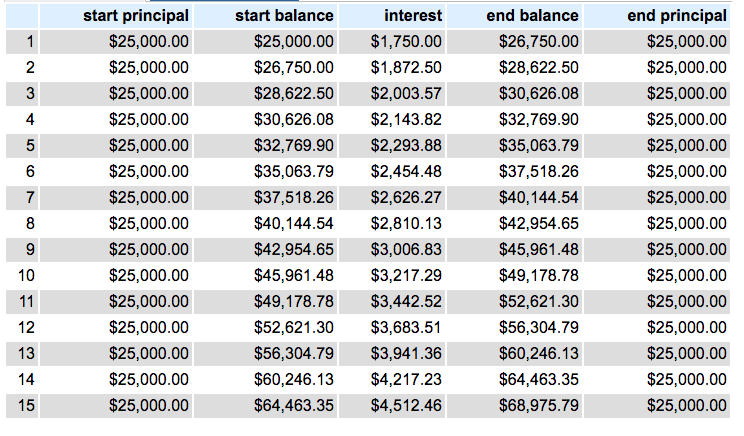

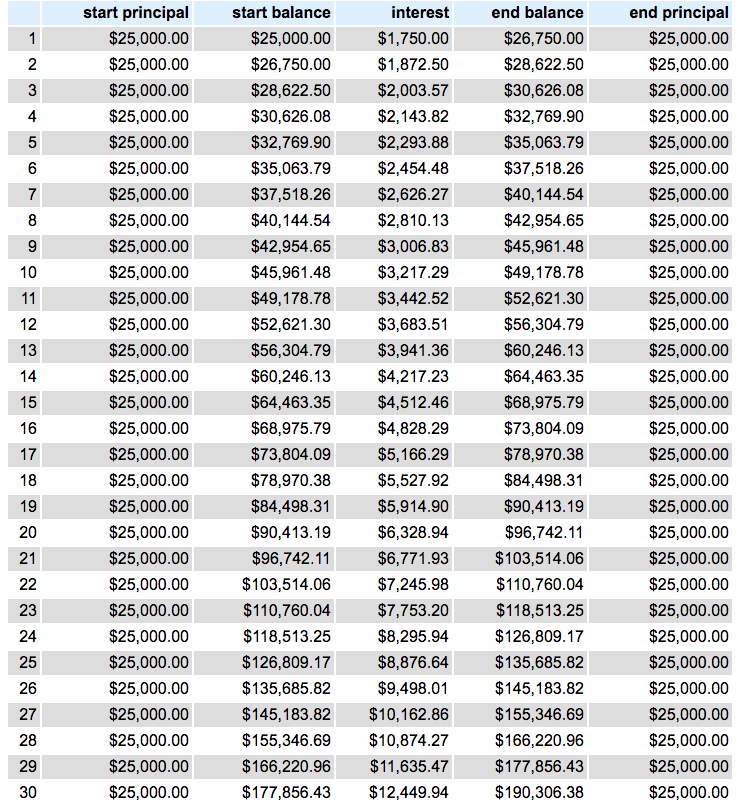

30-year break down below

In 15 years the $25,000 will be valued at $68,975

In 30 years $190,306

Rental Property Investment Route

John decides he is going to buy a house as a primary residence and has all intentions of living in it for 1st year. Then he will turn it into a rental property. He also very much likes the idea of always having a home base and also likes the tax advantages of owning.

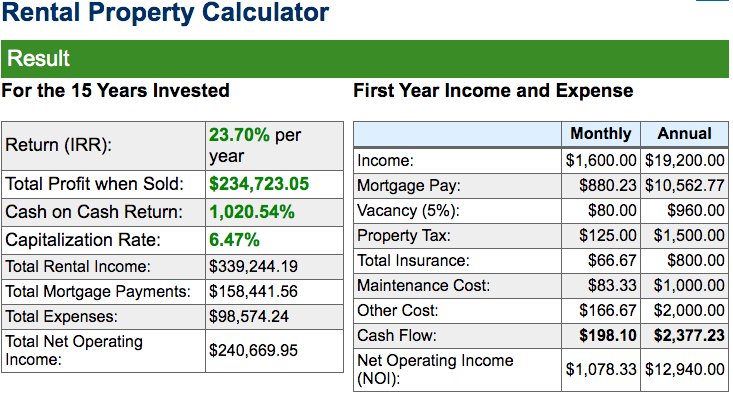

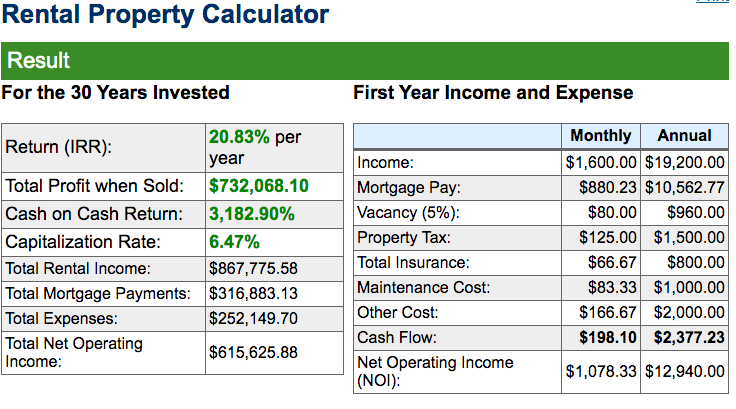

Right now John could buy a home for $200,000 easily rent that home out for $1600 a month. Let’s apply a 3% increase annually to all incomes and debts across the board

30-year break down below.

In 15 years this investment would be valued at $234,723

In 30 years $732,068

Possible difference in 30 years $541,762 going rental route!!

Please remember these numbers and figures are very much pro forma and this is an investment. We tried to take a conservative approach but we all know markets go up and down. For a detailed personal application you must consider your specific market, target product, time frame, personal financial and credit standing. The importance of aligning yourself with the right team is most important. Please do not hesitate reaching out to us anytime for more information or guidance in this process:)

Our Proven and preferred Team

Ryan Gilliam Waterstone Mortgage

( Purchase loans, Refinance, Equity lines and credit repair )

https://gilbert-az.waterstonemortgage.com/RyanGilliam.htmlJames Laubham Capital Accounting

( taxes, payroll, accounting, Business development, estate planning )

https://www.capitalacctpc.com/

Matthew & Katie Lambert Team EVOAZ.com

( real estate services, Sales, rental, and development)

https://www.evoaz.com/long-term-investments