Katie Halle Lambert

Phew! A Little Relief in The Market…

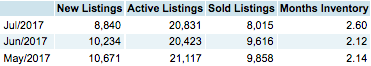

July’s inventory levels are a little higher than June which is common this time of year here in AZ however they aren’t much higher. We are still at less than 3 months inventory Valley-wide and that’s a healthy sellers market. Good news coming out of the mortgage industry for conventional home buyers. If your Debt To Income levels have been keeping you from qualifying then it’s time to try again.

Top 10 Most Expensive Home Sold In Phoenix 7/24/17 To 7/31/17

Search All Available AZ Homes: https://www.teamevoaz.com/index.php?rtype=grid

6015 E ONYX AVE, Paradise Valley, AZ 85253

9290 E Thompson Peak PKWY 417, Scottsdale, AZ 85255

27333 N 90TH ST, Scottsdale, AZ 85262

4551 E FOOTHILL DR, Paradise Valley, AZ 85253

6166 N Scottsdale RD A3005, Paradise Valley, AZ 85253

11250 E COCHISE DR, Scottsdale, AZ 85259

20682 E SUNRISE CT, Queen Creek, AZ 85142

5921 N ECHO CANYON LN, Phoenix, AZ 85018

10365 E JENAN DR, Scottsdale, AZ 85260

9333 E PINNACLE VISTA DR, Scottsdale, AZ 85262

Top 10 Most Expensive Homes Sold In Phoenix 7/3/17 To 7/10/17

Search All Available AZ Homes: Click Here

10512 E Cortez DR, Scottsdale, AZ 85259

7373 E VALLEY VIEW CIR, Carefree, AZ 85377

5001 E VALLE VISTA WAY, Paradise Valley, AZ 85253

20406 E SUNSET CT, Queen Creek, AZ 85142

6901 E 1ST ST 1003, Scottsdale, AZ 85251

6001 E FOOTHILL DR N, Paradise Valley, AZ 85253

6840 E Bronco DR, Paradise Valley, AZ 85253

7647 E Poinsettia DR, Scottsdale, AZ 85260

36631 N Peaceful PL, Carefree, AZ 85377

5909 E SOLCITO LN, Paradise Valley, AZ 85253