Is the Phoenix Real Estate Market finally on Summer Break?

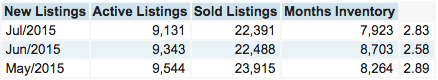

It happens every year but usually we see it at the beginning of July vs the end. The market is finally showing signs of the summer slow down. Up from 2.58 months inventory in June to 2.83 in July and down just a tad in sold listings, we are finally seeing the numbers reflect it. For buyers, this might be a good time to find that perfect home…while you have a little breathing room before the market kicks up again. For sellers, it’s still a sellers market but you might want to air on the side of realistic with your pricing and negotiation terms. The more inventory creeps up, the more choices the buyers have.