10 Things Buyers Should AVOID When Buying a Home

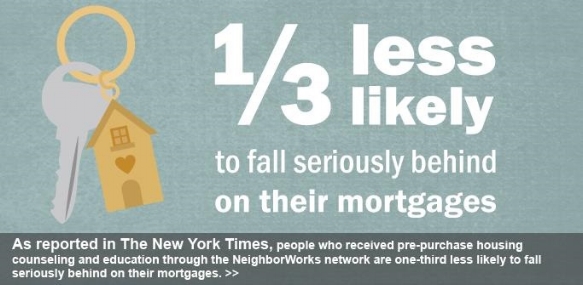

1. Not Educating Yourself on the Buying Process

One of the best tips we can give to anyone who’s buying a house for the first time is to get educated on the steps to buying a home. Too many first-time homebuyers are jumping into the housing market before knowing what they are getting into. Team Evolution has a full-time Client Education Specialist ready to teach you the whole process so you’re educated before going out to view homes!

2. Not Having the Right Real Estate Team in Place

As a homebuyer, it’s important you assemble the perfect group consisting of the right real estate team, mortgage lender, and home inspector. A single agent that has to wear many hats can’t possibly deliver the highest quality service to their clients when trying to multi-task. A well-rounded team is specialized in their specific roles to give you the best experience possible!

3. Overextending Your Budget

4. Finding the House Before the Location

One thing that buyers should try not to settle on is location. You may get the home you want, but be completely unhappy with where you live. Consider things like schools, crime rates, and commute times when determining what location you’d like to live in.

5. Don’t Shop Without Your Pre-Qual

It’s extremely important to talk with a trusted lender before going out to view homes. They will assess your credit and give you a target price range. The worst thing you can do to yourself is view a home you love before getting pre-approved and then find out it’s not available when you are finally ready!

6. Don’t Make a Major Purchase

When buying a home, it’s not a good idea to make any major purchases such as the brand new car you’d love to see in your new garage! If you add new debt that affects your debt to income ratio, it may hurt your home qualification. It’s always a better idea to wait until after your new home closes to go shopping.

7. Lowballing Instead of Negotiating Realistically

Lowball offers run the risk of being rejected or lengthening the process and annoying the sellers. It’s always a good idea to look at the last 90 days of comparable sales to get a target range of what is a realistic offer.

8. Always Looking for a Better Deal

Many homebuyers will drive themselves up the wall trying to always find a “better deal”. The market is always changing, but it’s tough to predict what will happen. If you continue to hold out for the next best deal you will never find what you’re looking for and never be happy.

9. Don’t Change Jobs Unless Necessary

Lenders like to see a consistent job history. They aren’t usually as nervous if you change jobs within the same field, but it’s better to stay put until the new home is yours and then pursue job options!

10. Seeing TOO Many Homes in One Day

Many buyers get in their minds that it’s best to view every home on the market in their price range. Seeing too many homes in one day will exhaust and frustrate you and the homes will all run together. A healthy number is 3-5 homes to view in a day. Be sure to take some pictures of your own and make notes!