Hello friends, family and clients of Team EvoAZ at eXp Realty. We hope this message finds each and every one of you well. We felt it important to connect during this time to give you accurate information concerning the real estate market here in AZ especially since we have been getting so many questions from many of you. This is NOT fake news. Be careful out there, there is a lot of assumption going around.

Please contact me with any questions about the current market conditions and your personal situation.

PS: We will always be here for our clients as a trusted, experienced resource. We will never close our doors to our clients and friends and will always continue to serve even in times like these when we have to be creative. Due to the current circumstances, we have alternative ways to market our listings and help our buyers find their dream homes right now and have not slowed or closed like other companies have such as Zillow, Open Door and Redfin. We are humans, just like you, and we will continue to be humans serving humans for the duration.

REAL ESTATE UPDATE

CREDITS: This article is originally from Michael Orr

Important information regarding our real estate market from the most intelligent person on the subject: Arizona Real Estate Economist, Michael Orr ?

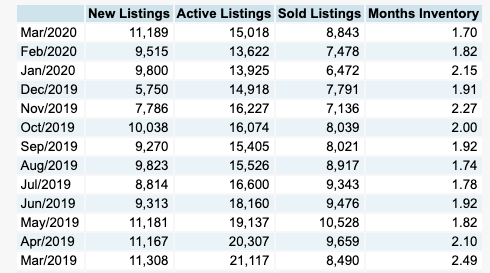

March 18 – A number of people seem to assume that we are heading for a recession and that home prices will fall. The first assumption is quite reasonable. The second assumption is based on fear and has little analytical data to back it up. Obviously anything can happen in a uncertain and disrupted world, but a fall in home prices is still looking very unlikely from today’s numbers.

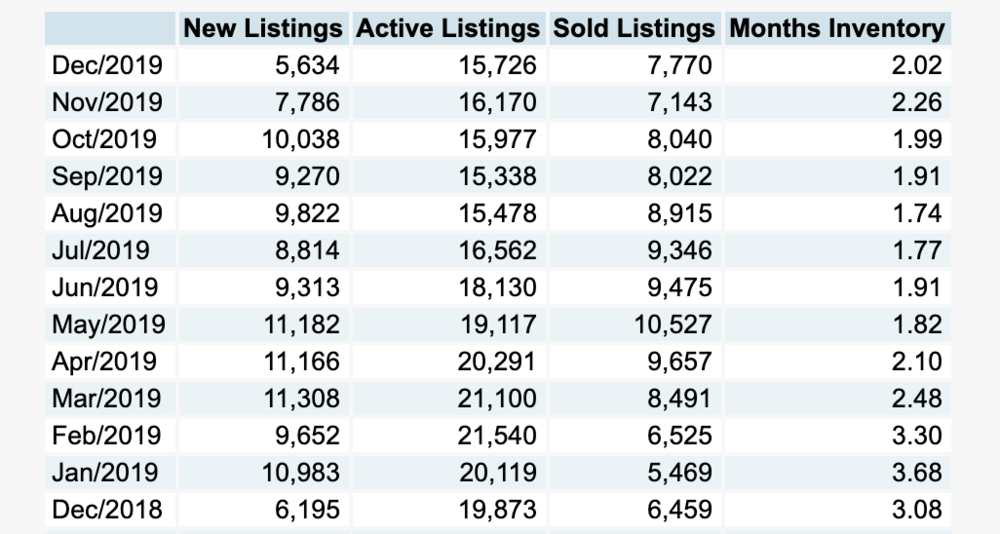

In 2005 the housing industry started to sicken because homes were being used as speculative commodities not for places to live. In 2005 I met a man in his early 20s who owned 12 homes in the Phoenix area, all with no occupants. How had he been able to buy them? 100% loans from unscrupulous lenders who went bust between 2007 and 2010. The housing industry (and more particularly the lending industry within it) was the cause of the 2008 recession. Phoenix was a hot spot for the cause of the problem, as was Las Vegas.

In 2020, housing is an innocent bystander to a probable recession caused by a pandemic. It has supply at extremely low levels and most homeowners have a large amount of equity. Even if they lost all their income and could no longer pay their mortgage, they could quickly find a buyer to release that equity. There is little likelihood of them facing foreclosure because the lender can be paid off with the sale proceeds. Only when demand collapses do the banks have to foreclose to get their money back. At the moment demand is still well above normal and has only shown very tiny signs of easing. In 2006 demand fell off a cliff yet home builders continued to build even more new homes because lenders continued to write ill-advised loans in huge numbers.

In 2020 builders are probably going to have to build fewer homes than they wish because of shortages of labor and materials. We are unlikely to see a glut of homes on the market for a very long time. A successful vaccine for the novel corona virus is more likely to appear before a surplus of homes could possibly develop.

Because the virus has not been contained yet, except in several parts of Southeast Asia, we are likely to see a lot of people out of work. We do not yet know how long it will take to get control of the pandemic in Arizona, but many people may be out of work for quite some time. These people are more likely to be renters rather than homeowners. Landlords may find it much harder to collect rents and the yields from their portfolios are likely to fall. Some may decide to evict tenants and sell their properties. At the moment the extra supply would be welcomed and receive multiple offers, even in these troubled times. The evicted tenants still exist and therefore still represent demand for shelter of some sort. There will be hardship, but not a flood of homes with no-one to live in them.

Housing demand is created by the existence of people and increases when more people turn up and decreases if they go away. In 2005 the people we were building new homes for were largely imaginary. In 2020 they are very real and migration trends have been very favorable with families and individuals moving to Arizona from other parts of the USA.

All the indicators for the Central Arizona housing market remain very healthy at the moment and we will report any change as soon as we spot one. There is no cause for panic and if you are delaying a purchase because you think the price will come down, you are probably making a poor decision.